What is Dextools? and What Does it Do?

27th December 2022

What is Dextools?

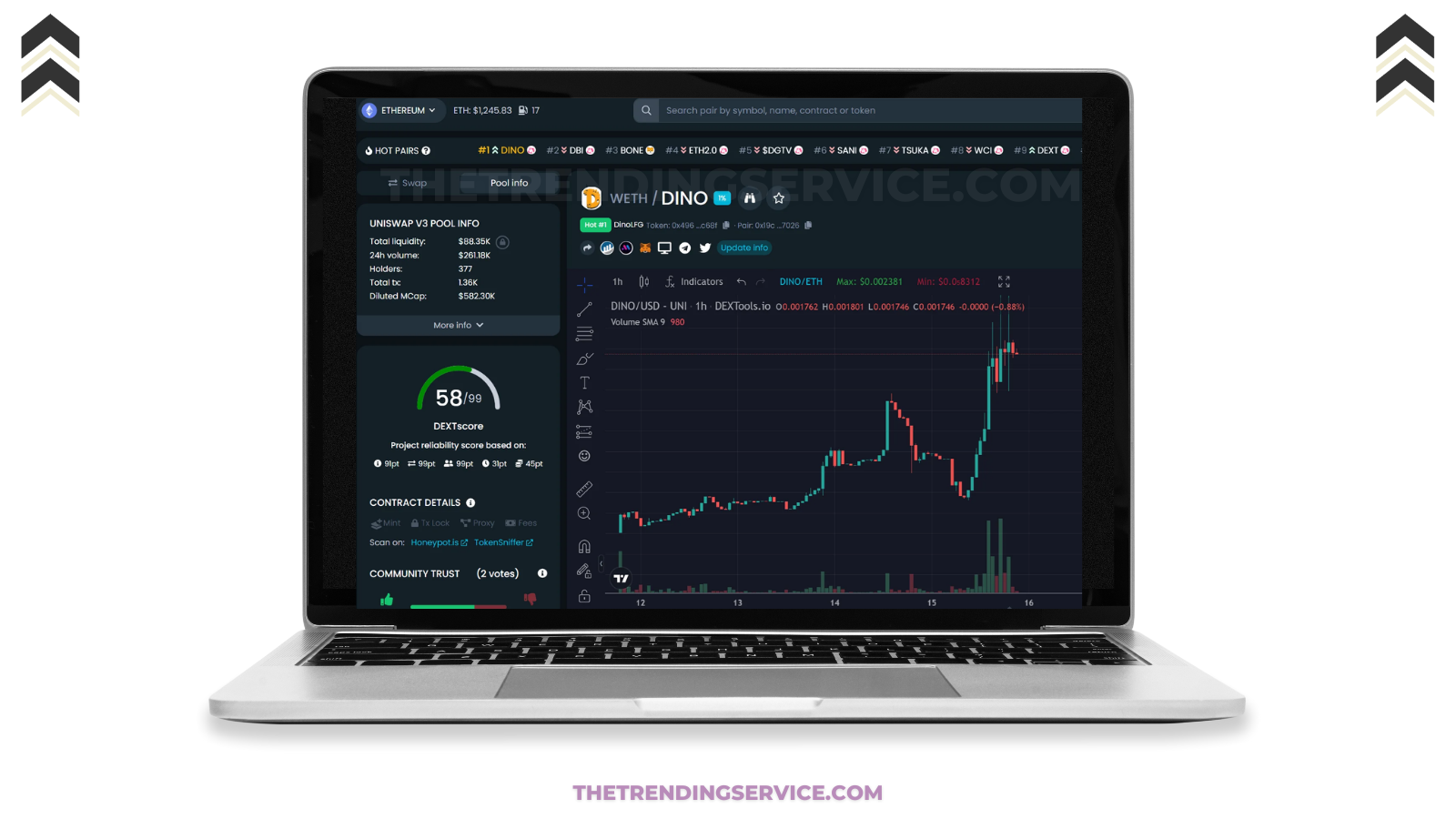

DEXTools is a real-time analytics platform for cryptocurrencies traded on decentralized markets.

Any cryptocurrency trader who often uses decentralized exchanges (DEXs) like Uniswap or SushiSwap will find this an ideal tool. The protocol provides analysis that may assist in creating one-of-a-kind trading strategies, searching for large spreads, anticipating market movements, tracking and copying the wallets (Whales), and other services that generate the highest profit.

What is a Decentralized Exchange?

Decentralized exchanges, also known as DEXs, offer some of the most important services available in the cryptocurrency industry. However, because they trade even the least well-known tokens, they are frequently significantly impacted by issues relating to liquidity. Because of this, producers of cryptocurrencies have devised various strategies to lower the expenses associated with multiple coins and increase their liquidity.

They have created solutions like DEX aggregators, liquidity pools, and now DEXTools to solve the issue. DEX aggregators monitor the best values for tokens offered on various exchanges in their many divided forms, then combine all of those prices into a single transaction. Liquidity pools are a feature found in virtually all trades, including CEXs. These pools allow users to lock their assets and development by providing liquidity for other users.

These solutions ensure that an exchange has sufficient liquidity for a particular token. This will allow traders to buy and sell the tickets at values comparable to the market range. Slippage is avoided by doing so, which occurs when the price at which a specific token swap occurs is more than what it sells for on the market. DEXTools provides consumers with an in-depth look at their needs, helping them minimize slippage on DEXs. The following is more information concerning the functionality of DEXTools.

An Overview of Dextools

DEXTools released its dapp in June 2020 as a public beta version with 200 million DEXT tokens available. It was established by Frederic and Javier, who had extensive expertise in the trading and development industries, using their funds. DEXTools was established in 2020

by two people who became friends after meeting in a traders' club in 2017. A month later, the group recruited Pablo as their first Chief Technology Officer to establish the groundwork for supplying professional services through the platform. Since that time, the instrument has been garnering the attention and adoption of the Defi community, which has essentially made DEXT a key hub for the trading of Defi.

The platform keeps its one-of-a-kind status by emphasizing the accuracy and timeliness of the information it delivers to its customers. In addition, the platform makes an effort to maintain its level as a community-based resource by basing some of its growth on community feedback and projects such as DEXT Force and DEXT Force Ventures.

The Basics

Key Features of Dextools

POOL EXPLORER

DEXTool is a famous pool explorer that helps players quickly locate popular pools. To top it all

off, the analysis is already done, so it's possible to discover new gems and calculate the entire

worth of the rocks in a pairs pool with no effort. A user can also keep an eye on the liquidity

trends in a much easier way to see how they will affect the tokens in question (Bearishly or

Bullishly).

This feature also puts all the essential links, like the explorers or DEX pages for the tokens, in

one place, making it easier to check the information. It also has a quick link that lets you check

the liquidity of the pools through Unicrypt.

PAIR EXPLORER

The function known as the pair explorer makes it possible to monitor the real-time price action

charts of assets and allows users to follow the tokens that they find most interesting. DEXTools

also makes a score for each pair of tickets, which can help you avoid scams that are easy to

spot. Both free and paid users can set up decentralized limit orders or algorithmic trading bots

on the platform

PROFIT & LOSS TRACKING

Maintaining track of users' holdings across all available altcoins is challenging, mainly if they are

trading the currencies among farming pools. This is especially true when the users are selling

the coins. There is a P&L Tracking feature built into DEXTools that can do all of that work for its

users. It creates a trading journal that lets users keep track of their trades and improve their

trading strategy over time.

BIG SWAPS

The Big Swaps tool on the platform makes it possible to keep track of big traders, who are often

called "crypto whales." It is known that these traders can easily manipulate the markets,

especially when a token doesn't have a lot of buyers. For example, a whale sale can help users

catch a dip if the platform tells them about it.

NOTIFICATIONS

The platform lets users set up the desktop, email, and Telegram alerts for the prices of their

favorite tokens. Users can improve their trading strategies with this tool. It is also easy to set up

and helpful for traders who use highly developed trading options like derivative products.

MULTISWAP

The technology gives users the ability to engage with several pairings on a single screen at the

same time. Because of this feature, the accessibility of the platform's tools is improved, which in

turn leads to an improvement in the users' contact with the market

$DEXT Tokenomics

As of 27th December 2022 the token's current market capitalization is $29,449,350, which places it at position number 622 on CoinMarketCap's ranking system

DEXT Share

Since DEXT share receives the remaining 90% of subscription fees, it plays a significant role in

the tokenomics of the coin. DEXT holders who own at least 100,000 tokens will get this money

at a value proportional to their holdings. For these holders, this functionality is fantastic because

there is no need to lock up or stake the money because they will receive rewards passively by

just hanging about in their wallets.

The protocol takes a monthly snapshot and airdrops DEXT tokens to premium holders. This

method is relatively efficient because you can generate money without paying for gas.

Additionally, the subscription costs for team wallets are not shared. Thus they entirely go to the

holders.

How Dextools Works

By selecting a pair and the DEX they want to utilize after clicking the "Multiswap" button, users of DEXTools can make atomic swaps of tokens directly. The setup will be ready for usage once the user has completed those steps and connected their wallets to the chosen DEX.

The platform's user interface makes it simple to monitor its functionality. Users only need to click the buttons on the services they want to utilize, like TradingView charts, to access them. They can also access various charting tools to follow the market and preserve the analysis for posting on social media.

USERS CAN CONNECT THEIR WALLETS TO UTILIZE THE PLATFORMS FUNCTIONS. ONLY THE FOLLOWING WALLETS CAN BE SUPPORTED:

DEXT Subscription

It is also important to remember that DEXTools requires membership for premium services,

even though most of its functions are free. Users can access the regular plan with 1,000 DEXT

in their wallets or pay a monthly subscription fee of 277 DEXT. More transaction and wallet data,

price alerts via email and Telegram, access to the DEXT Force Discord channel, and twelve new

hot pairs are all included in the Standard plan, all of which are absent from the Free edition

Access to DEXTForce

Only users with more than 100,000 DEXT in their wallets can purchase the premium version.

The airdrops from the DEXTShare protocol are just one of the benefits for premium holders.

Additionally, they receive priority access to DEXTForce Ventures, 15 hot pairs with speedier

notifications, and all the platform's new features.

Onward Outlook For Dextools

DEXTools, like the broader DeFi industry, is seeing explosive growth. It continues to operate

with the goal of "doing for DeFi what cryptographic blockchains achieved for value and

information transmission,"

The platform is a cutting-edge solution for DeFi and other cryptocurrency token traders because it makes their work more straightforward and successful by analyzing market trends. It currently ranks among the most widely used and essential tools in the crypto world.

Conclusion

One of the top tools in the Defi industry is DEXTools.

Through real-time trading charts from Tradingview, one of the leading blockchain analysis tools, it is possible to follow the trends in the cryptocurrency market. The platform (DEXTools) delivers various services according to the user tier levels. It comes in three price tiers: free, regular, and premium. It delivers most of its functionality in the free edition because it is community-based.

It is also decentralized and does not charge its development team subscription fees. Instead, it distributes 90% to the holders and burns the remaining 10% to maintain deflation. Additionally, it enables users to participate in the most critical procedures, such as the protocol or upgrading

that considers their recommendations. Users who enjoy minimizing market fluctuations using passive income can also benefit from this investment idea. Only premium users can access the platform's passive income feature via airdrops without locking their assets.

Want to get your project featured on Dextools Trending?

Get in touch with us today

GET IN TOUCH

© COPYRIGHT 2025, ALL RIGHTS RESERVED